jetcityimage/iStock Editorial by using Getty Photos

Introduction

As a dividend expansion trader, I search for new expense possibilities in money-producing property. When I locate these belongings to be attractively valued, I usually increase to my current positions. In addition, I consider benefit of market volatility as we see it currently by starting new positions to diversify my holdings and improve my dividend profits with much less funds.

In the course of a recession like the a single economist forecast, the client discretionary sector may well underperform as consumers adhere to their basic charges. It can be an opportunity to appraise businesses in this sector as the weak point might only be momentary, still the extended-term potential customers continue to be intact. One particular of these providers is Residence Depot (NYSE:High definition), which traded for a significant valuation for a lengthy time.

I will review the corporation employing my methodology for examining dividend development shares. I am utilizing the similar approach to make it less difficult to look at researched organizations. I will study the firm’s fundamentals, valuation, progress possibilities, and risks. I will then try out to ascertain if it truly is a superior expense.

Trying to get Alpha’s organization overview displays that:

The Home Depot operates as a residence advancement retailer. It operates The Residence Depot retailers that promote different developing components, residence advancement merchandise, lawn and backyard products, décor solutions, and amenities servicing, maintenance, and operations products and solutions. The corporation also presents set up services for flooring, cabinets and cupboard makeovers, counter tops, furnaces and central air techniques, and home windows. In addition, it supplies resource and equipment rental providers.

Fundamentals

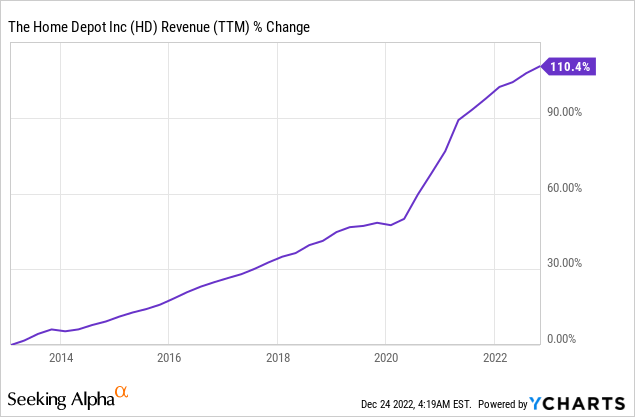

The revenues of Household Depot have been steadily expanding more than the past 10 years. Revenue have far more than doubled, which suggests they grew at an annual price of almost 8%. Profits greater quickly during the pandemic as more individuals put in far more time at house. As a result its appearance turned more critical for them. In the upcoming, as found on Trying to get Alpha, the analyst consensus expects Property Depot to preserve growing sales at an once-a-year fee of ~3% in the medium term.

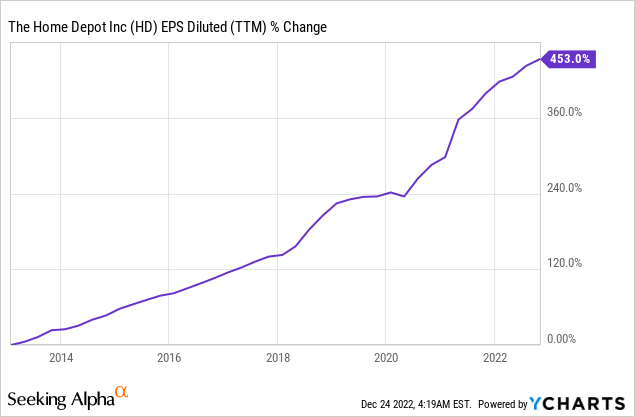

The EPS (earnings for every share) has been escalating much more rapidly all through the exact period of time. The EPS greater by 450%, which means it is extra than 5 times higher than it was just a ten years in the past. The enterprise achieved EPS growth by growing gross sales, obtaining back its shares, and improving upon margins by earning a much better electronic knowledge and cutting costs. In the future, as seen on Trying to find Alpha, the analyst consensus expects Dwelling Depot to keep escalating EPS at an annual fee of ~5% in the medium expression.

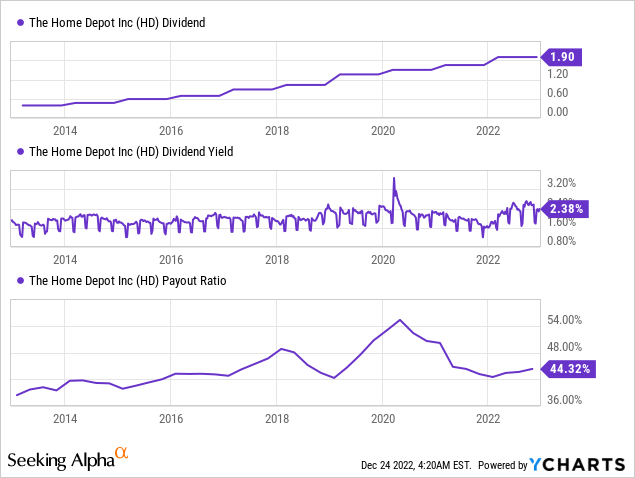

The enterprise is a dependable dividend payer. It has not lowered the dividend for far more than 30 years and improved it each year for 13 years, like a 25% improve last February. The dividend looks not likely to be reduce as the business pays considerably less than 50% of its EPS. In addition, the entry produce is better than its 10-yr regular. Whilst the typical development price above the final 5 many years was 18%, traders should hope slower dividend progress in the medium phrase, as the EPS advancement is slowing down.

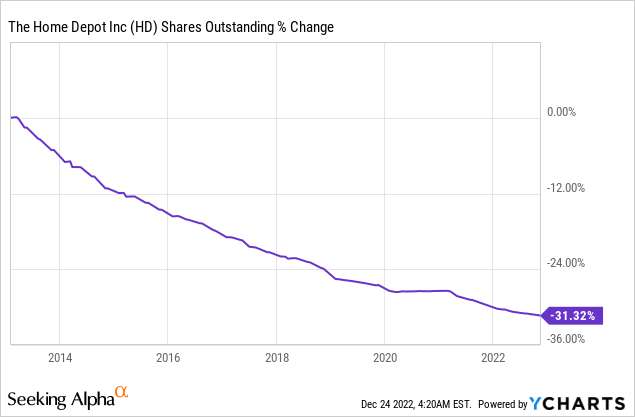

In addition to dividends, businesses like Residence Depot reward their shareholders by means of share repurchase options. Buybacks assist EPS development over time as they reduced the amount of remarkable shares. Residence Depot acquired again practically a person-third of its shares in the previous 10 yrs. Buybacks are remarkably economical when shares are attractively valued, and if the volatility persists, it may be an possibility.

Valuation

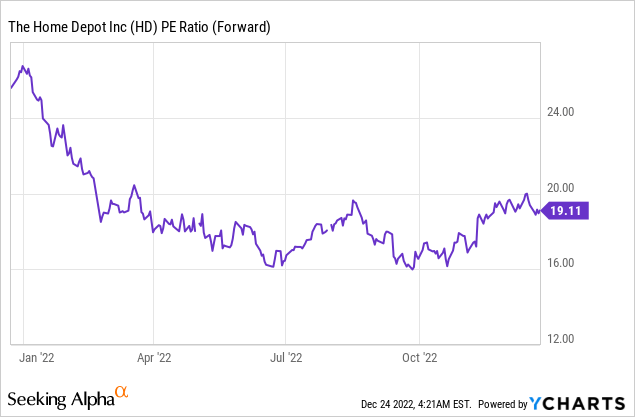

The P/E (rate to earnings) ratio of the Residence Dept is standing at 19.11 when having into account the forecasted EPS of the existing year. It is decreased at 18.8 when looking at the 2023 EPS forecast. About the final twelve months, the valuation has lowered from a P/E ratio of 25 to a small of 16. The consumer discretionary sector tends to be cyclical, so a difficult enterprise environment affects its valuation swiftly.

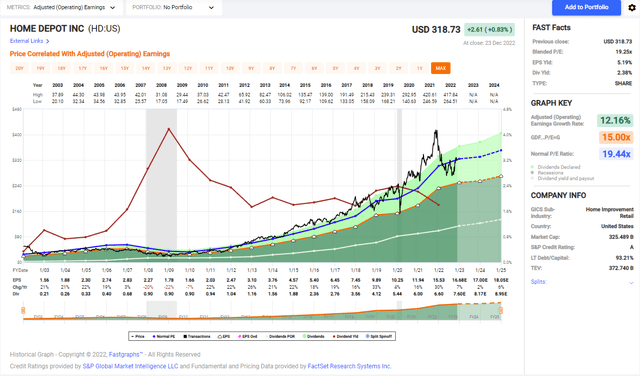

The graph down below from Fastgraphs reveals that House Depot is lastly at its historic valuation once again, a unusual event in the past 5 decades. The existing P/E ratio is like the P/E ratio we have witnessed in the prior twenty many years. Nevertheless, investors should also be informed that the forecasted development price for the firm, which stands at 5% every year, is slower than the 12% we noticed in the last two decades.

Fastgraphs

Household Depot presents investors some good fundamentals with development in product sales, EPS, dividends, and buybacks. The valuation of the stock is in line with its historical valuation. Though it may possibly be tempting to leap into a stock at a historic valuation, it is vital to meticulously take into consideration the company’s advancement prospective clients and probable dangers, as they could have a profound influence on its EPS development.

Prospects

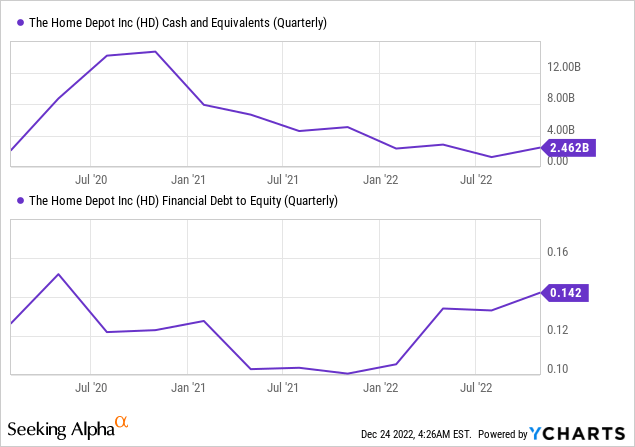

One option in investing in House Depot is the firm’s reliable financials and marketplace management. Residence Depot is the largest home enhancement retailer in the earth, with a presence in all 50 states and solid brand name recognition. In addition, Residence Depot has a solid stability sheet with a small financial debt-to-fairness ratio and a potent money placement of more than $2B. These things counsel that the corporation is effectively-positioned to weather economic downturns, proceed increasing in the very long time period, and maybe even purchase some opponents to boost its benefit proposition.

Yet another chance in investing in Residence Depot is the increasing demand from customers for house advancement products and solutions and solutions. The craze of householders remaining in their households for a longer period and investing in house renovations has been rising in modern several years, mostly because of the pandemic. Even as the financial system is again to typical, we however see distant work, learning, and hybrid jobs. Far more time at residence will see a corresponding maximize in desire for home improvement products and solutions and services. It bodes perfectly for Property Depot, as the enterprise is nicely-positioned to capitalize on this pattern with its wide variety of products and services.

An additional opportunity in investing in Home Depot is the company’s diversification. It provides not only merchandise but also the providers to establish and set up them. It serves both equally finish end users and gurus who resell it to their consumers. Additionally, it is growing into new countries these as Canada and Mexico. Featuring far more companies and products and solutions in much more markets with an enhancing digital benefit proposition is critical for future advancement.

Hazards

1 danger in investing in Property Depot is the probable impression of economic downturns and recessions. Residence advancement assignments are generally regarded as discretionary expending, this means they may be among the initially charges to slash in the course of financial uncertainty. If the overall economy ended up to enter a recession, this could guide to a decrease in need for property improvement products and expert services, which could negatively impact Dwelling Depot’s financial overall performance.

A further danger in investing in Home Depot is the competitiveness from other suppliers and on the internet sellers. The property improvement retail marketplace is extremely aggressive, with quite a few distinguished national and regional players vying for sector share, as Dwelling Depot has a sizeable 18% share. In addition, e-commerce has manufactured it easier for consumers to shop for property improvement items on the net, most likely leading to a decline in retail store targeted traffic for Residence Depot. Residence Depot is battling for sector share and provides expert services needed to use the merchandise.

In addition to the threats stated higher than, yet another threat in investing in Property Depot is the opportunity affect of interest premiums. Higher desire costs can make it a lot more pricey for customers to finance property enhancement jobs, perhaps foremost to a drop in need for the firm’s products and solutions and expert services. It indicates that even if lots of customers have been not influenced by the economic downturn, they may wrestle to finance costly residence renovation tasks. They might possibly hold off it or commit time. Both equally are complicated for Dwelling Depot.

Conclusions

In general, Dwelling Depot has powerful fundamentals, a fair valuation, and first rate possibilities for expansion. Nevertheless, it is important to note that the organization also faces many challenges, significantly in the small and medium term. Buyers should really expect continual dividend progress, however possibly at a slower tempo in the coming yrs as the business sails by way of a harsher organization surroundings.

Right after thinking of all of the over factors, I believe that that Home Depot is a Keep at the existing time. Investors ought to take into account slowly but surely developing a placement in the organization over time by purchasing on dips. It can aid to ordinary out the buy value and potentially mitigate risk. Rating it as a Buy would have intended that this is an eye-catching entry selling price. But, with slower progress and risky marketplaces, I believe traders really should purchase gradually. An eye-catching cost will be a forward P/E of 14-15, as we have observed this calendar year.